are dental implants tax deductible in canada

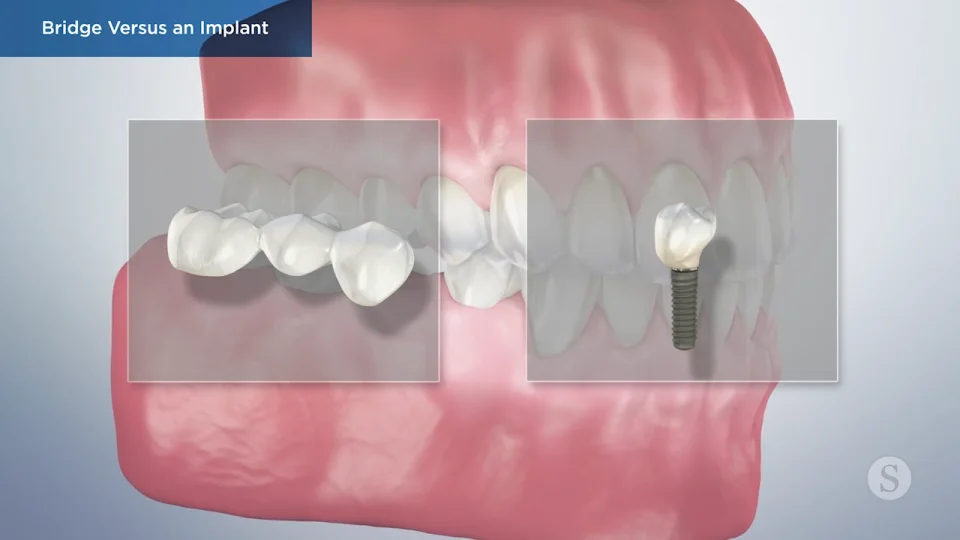

January 22 2021 349 PM. Denture implants and dental implants are eligible medical expenses that you can claim.

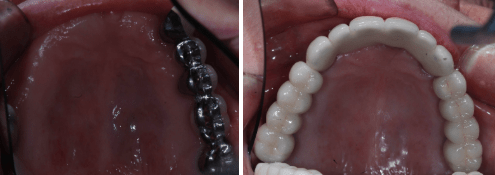

Dental Implants Faq Vancouver Centre For Cosmetic And Implant Dentistry

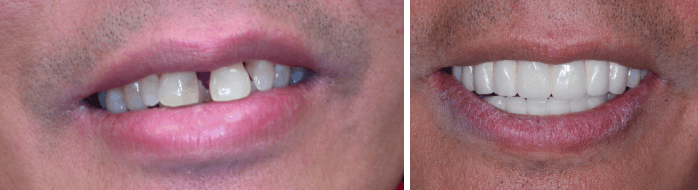

Dental expenses can be a big part of an individuals or a familys medical expensesDental procedures such as root canals fillings and repairs and.

. The total of all itemized deductions must exceed this threshold for your dental implant expenses to yield any tax savings. This brings us back to the question are porcelain crowns. I am 79 years of age with no dependants other than my - Answered by a verified Canadian Tax Expert.

Are Dental Implants Income Tax Deductible. Of course your medical expenses plus your other itemized deductions still have to exceed your standard deduction before you will see a difference in your tax due or refund. Only the expense that you paid.

How to claim tax deductible for dental implants Canada. What personal expenses are tax deductible in Canada. I pay only half of the amount in 2022 and will pay off when it finishes in 2023.

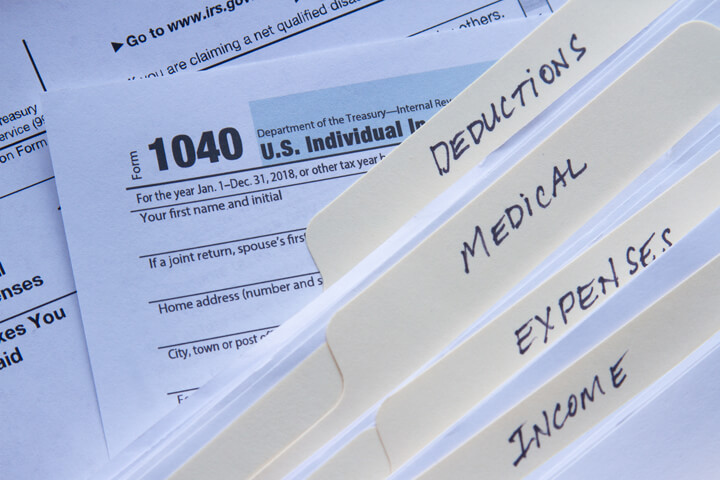

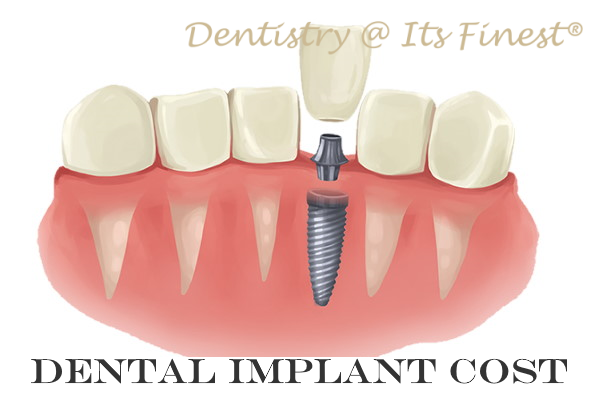

The short answer here is yes they may very well be. In fact it shows great foresight. In Alberta Canada you can expect to pay anywhere between 900 to 3000 for a single dental implant.

Claiming deductions credits and expenses Home office expenses for employees. 22 2022 published 512 am. Meanwhile a full mouth reconstructive dental implant will cost you up to.

Even if you have insurance coverage that includes implant treatment. The good news is yes dental implants are tax deductible. 502 Medical and Dental Expenses but its not exactly in plain.

Makayla Searight 030822 2 minutes 17 seconds read 0 Replies. The IRS addresses this in Topic No. Up to 15 cash back Are dental implants tax deductable in Canada.

May 3 2021 By Staff. You were 18 years of age or older at the end of 2021. Are dental implants tax deductible.

What dental expenses are tax deductible in Canada. In another source a dental implant can cost anywhere in the range of 1500 to 6000. This is not an odd question at all.

My implant procedure spreads 2022 and 2023. 4 may 2011 canada revenue agency cra was recently asked whether the cost of dental implants would qualify as medical. You were resident in.

To help you with this cost the canada revenue agency allows dental expenses to be used as medical. You made a claim for medical expenses on line 33200 of your tax return Step 5 Federal tax or for the disability supports deduction on line 21500 of your tax return. Yes the dental implant is a medical expense deductible as an itemized deduction on Schedule A.

Are Dental Expenses Tax Deductible Dental Health Society

Are Dental Expenses Tax Deductible Dental Health Society

12 Easy Ways To Get Affordable Dental Implants In 2022 Authority Dental

Dental Implant Cost In Gurgaon India 2022 Update Dantkriti Dental Clinic

Dental Implant Torque Control Universal Torque Wrench Right Angle Variable Torque Wrench Driver Universal Implant Torque Treedental Treedental

Are Dentures Dental Implants Tax Deductible Calgary Dentures

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit

Are Dental Implants Tax Deductible Drake Wallace Dentistry

What Dental Work Is Tax Deductible

How To Get The Best Dental Insurance For Implants The Teeth Blog

Does Medicaid Cover Dental Implants Grants For Medical

Dental Implant Grants Free Money Tooth Implant Procedure With Government Cdg Programs Explained

Dental Implants Boston Tooth Implant Boston Ma Replacement Teeth

Dental Implant Cost Costa Mesa How Much Does Single Tooth Implant Cost In Orange County Dentistry At Its Finest

Are Dentures Dental Implants Tax Deductible Calgary Dentures

How To Get The Best Dental Insurance For Implants The Teeth Blog

Dental Implants Faq Vancouver Centre For Cosmetic And Implant Dentistry